It’s that time again! Tax season is a stressful time of year for many people, but it can be even more so if you are new to the country and unsure how the system works. It doesn’t need to be so bad though – we offer gere some general information about how taxes work that might alleviate some of the stress of the unknown.

Tax Season

The tax authority of the United States is the often-feared Internal Revenue Service. The IRS is the tax authority at the federal level that will expect you to pay income and other civil taxes. You’ll also be required to pay state taxes to the state in which you reside; these taxes are often less than those on a federal level, but can still end up being pretty significant – especially in New York.Tax season is the period between January 1 (end of the previous tax year) and April 15 each year. April 15 is the last day by which you must either file your taxes or submit for an extension. An extension provides an extra six months to file your return but you must still pay any extra tax owed by April 15.

LET’S TALK INCOME

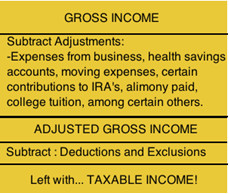

So what portion of your income is going to be up for taxation? The general equation of what your taxable income will be can be seen below: The adjustments listed above are identified by the IRS and state authorities on their respective websites and on the tax forms (i.e. 1040-NR) that you will be required to file. Most of these expenses are limited to a percentage of what was spent, or are capped at a specific amount. For example, you can’t lessen your income by the entire cost of moving to New York – but you can deduct a portion of the expense. Another example would be tuition costs. While you may pay $20,000 in tuition to NYU, the maximum adjustment for tuition expenses is capped at $4,000.The IRS also allows individuals to take deductions and exclusions. There is a standard deduction, increased every year to adjust for the cost of living. If you have dependents (children, spouses, etc.) you’re able to take an additional deduction for each dependent. Note that these dependents will need to be considered residents of the United States in order to be considered dependents for US tax purposes. There is the option to “itemize” your deductions, but it’s usually only recommended under specific situations – large charitable donations, for example, or large unreimbursed business expenses, uninsured theft, or medical expenses.

The adjustments listed above are identified by the IRS and state authorities on their respective websites and on the tax forms (i.e. 1040-NR) that you will be required to file. Most of these expenses are limited to a percentage of what was spent, or are capped at a specific amount. For example, you can’t lessen your income by the entire cost of moving to New York – but you can deduct a portion of the expense. Another example would be tuition costs. While you may pay $20,000 in tuition to NYU, the maximum adjustment for tuition expenses is capped at $4,000.The IRS also allows individuals to take deductions and exclusions. There is a standard deduction, increased every year to adjust for the cost of living. If you have dependents (children, spouses, etc.) you’re able to take an additional deduction for each dependent. Note that these dependents will need to be considered residents of the United States in order to be considered dependents for US tax purposes. There is the option to “itemize” your deductions, but it’s usually only recommended under specific situations – large charitable donations, for example, or large unreimbursed business expenses, uninsured theft, or medical expenses.

WHAT’S YOUR STATUS?

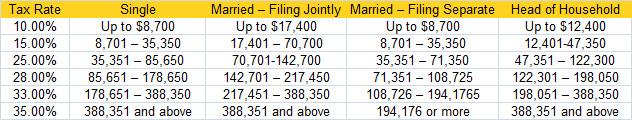

Residency StatusYour residency status will have a significant effect on what portions of your income are going to be taxable by the IRS and state authorities.If you are a resident alien, you, like all US citizens, are going to be required to pay US taxes on your income, regardless of its source. For example, if you have income coming from a company that you own in Switzerland, yet you live in the United States, you will be required to pay US taxes on that income even if you have already paid Swiss taxes on that income.As a non-resident alien, you will not be required to pay taxes on your worldwide income – only taxes that are derived from activities in the United States. This includes any income you have earned, be it from labor, investments, or inheritance from within the United States.Filing StatusThe United States has different filing statuses for different scenarios. The most common filing statuses are single, married – filing jointly, married – filing separately, and filing as head of household. Each has its benefits for certain taxpayers.If you’re single and without dependents, you will probably file as single – you do not qualify for the statuses with better tax advantages. Filing as head of household can be an option if you have dependents and meet the other requirements. This allows for higher deductions exclusions and can save significant money on your taxes.If you’re married, there are a number of tax benefits to filing jointly. There are more credits and deductions available to joint returns, your total tax owed is usually less, and you have the highest standard deduction of any filing status. You can instead opt to file separate returns which, at times, can be advantageous. For example, if your spouse has income in Switzerland that you do not want to pay US taxes on, it may be best to file separate returns so that this income is not included in your taxable income.

TAX RATES

As mentioned earlier, the tax rates in the United States are generally lower than those that you may be used to seeing in other countries. The tax rate is progressive and increases with your income. The tax rate which applies to you is also based on your filing status. You are also going to be taxed on capital gains in the United States. This includes investment income, income from savings accounts (both in the US and abroad), and any gifts or inheritance that are given to you. The rates vary based on your total income and the tax bracket you fall into. Low income may be exempt from capital gains taxes, but for higher incomes the rate can be as high as 35%.Staying compliant with the IRS is especially important for internationals as jail time or deportation can be the punishment for those found to be hiding assets abroad or being knowingly delinquent on income taxes.

You are also going to be taxed on capital gains in the United States. This includes investment income, income from savings accounts (both in the US and abroad), and any gifts or inheritance that are given to you. The rates vary based on your total income and the tax bracket you fall into. Low income may be exempt from capital gains taxes, but for higher incomes the rate can be as high as 35%.Staying compliant with the IRS is especially important for internationals as jail time or deportation can be the punishment for those found to be hiding assets abroad or being knowingly delinquent on income taxes.

STATE AND LOCAL TAXES IN NYC

You are going to see some of the highest taxes in the country as a resident in New York City. New York State also has some of the highest state income taxes in the country. The graduated rates start at 6.85% and are capped at 8.97%. Unlike other cities, the city of New York also taxes its residents on their income. The rates are based on what you earned. For example, if you earn between $22,000 and $22,050, you are taxed a flat $703. This also varies on your filing status.New York City also has some of the highest taxes on everyday items in the entire United States. The state and city sales taxes amount to 8.75% and are applied to any purchase not related to non-prepared food or drugs. Other items have flat-taxes associated with them, such as cigarettes. Taxes on a pack of cigarettes in New York City amount to $5.85 – no exceptions.

GETTING HELP

There’s a plethora of valuable information on the IRS’s website, including the best status for you to file under, the deductions and exclusions that are available, as well as other tax topics that the IRS covers. There is also no shortage of qualified tax advisors and certified accountants in New York City to help you prepare your tax returns and answer all of your tax related questions.For the do-it-yourselfers there are computer programs such as TurboTax or TaxAct which, for a fee, walk you through each step of the paperwork and filing process. There is also ample help available via New York City’s public libraries.The contents of the site do not constitute legal advice and while, to the best of our knowledge, this information is accurate at the time of publishing, it may or may not be correct, complete or current at the time of reading. The content is not intended to be used as a substitute for specific legal advice or opinions. Article updated 1/13/14.